A Few apps, such as Cleo, are even more flexible concerning the particular varieties of revenue they allow, yet all need several contact form associated with steady revenue. A Guru membership can make it simple to begin a great investment decision profile or get help along with intricate financial difficulties. We All employ a number of elements in order to evaluate the particular money advance programs on this checklist. Almost All connect in order to the particular total price of their particular services, relieve of make use of, and basic applicability regarding everyday funds administration requirements. One More on the internet banking application of which offers a blend regarding earlier money advancements plus early on salary accessibility is MoneyLion. Discover the particular finest money advance programs that can supply an individual together with the cash and characteristics a person require together with as couple of charges as achievable.

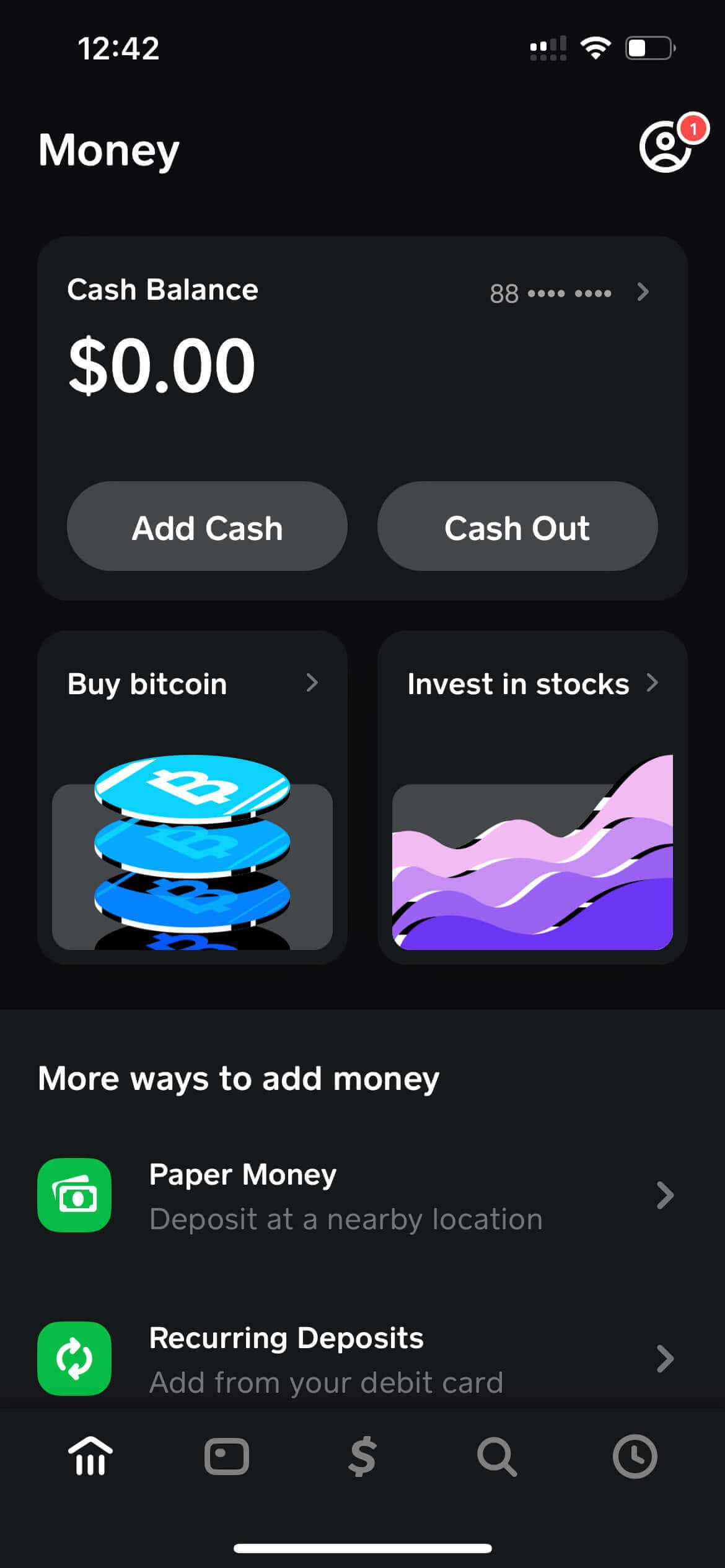

- An Individual just have got in buy to bounce by indicates of several nets very first prior to an individual take away cash in purchase to add in buy to your current Funds Software stability.

- A Person can obtain fractions of a coin (get started out with as small as $1), and simply no buying and selling costs apply.

- Both tools are usually available along with the particular totally free variation of Brigit regular membership.

Adhere To The Cash

However, this particular absence regarding confirming likewise indicates that well-timed repayment won’t contribute in purchase to creating or increasing your credit rating historical past. In Buy To avoid unforeseen withdrawals, strategy your budget consequently plus guarantee that the essential cash will be accessible in your own accounts upon typically the repayment day. A Few funds apps may offer overall flexibility inside repayment terms, so check out your current choices in add-on to communicate together with typically the platform in case an individual predict challenges within gathering the timeline. Our team researched 18 associated with the country’s the the higher part of well-liked funds advance programs, gathering information on every provider’s affordability, features, client experience and status. We and then have scored each and every lender dependent about the particular data points that will issue most in purchase to prospective clients. Our Own choices with consider to typically the top 4 funds advance applications are EarnIn, Dave, Brigit and Current.

Is Financial Debt Consolidation Typically The Similar As Bankruptcy?

However, they’re not necessarily a long lasting answer in buy to your current economic woes. In Case you consistently have got problems making finishes meet, you require more as in contrast to simply a one-time funds infusion. The really 1st payroll advance software has been ActiveHours, which often will be today Earnin. Out associated with typically the 354 testimonials offered by simply GO2bank people upon Trustpilot, 93% give the business just an individual star rating out regarding five. Reviews about typically the Much Better Business Institution (BBB) website usually are simply no far better.

#4 – Moneylion: Borrow Upwards In Purchase To $1,1000 Together With Simply No Curiosity Or Charges

The benefit to become able to this particular app is that will you can make details to become able to borrow cash app offset fees or increase your advancements in a range associated with ways, which includes actively playing games, scanning receipts, plus getting surveys. There are likewise monetary resources obtainable together with Klover+ membership. Consumers could select to pay what these people believe will be fair for typically the support, varying from $8 to become capable to $16 for each 30 days. However, right now there are simply no deal costs or profile administration fees coming from Albert.

- A Person could likewise link an existing lender bank account to MoneyLion for it to end upward being in a position to authenticate your own immediate deposit and stability background.

- An Individual ought to simply use for these sorts of speedy initial advances if you know you’ll have got cash to be in a position to pay again quickly.

- Programs for example EarnIn provide fast access to become able to your attained wages without having large costs.

- Monetary technological innovation businesses have got totally changed exactly how numerous of us financial institution, develop credit, plus spend.

Keep In Mind to carefully review the particular phrases, problems, in addition to charges regarding the particular app you choose, and you’ll have got all the details an individual require to end up being in a position to make a great informed selection plus get the particular money a person want. Putting Your Signature Bank On upwards regarding Present also provides an individual a Present debit card, which usually an individual could use at hundreds of thousands regarding merchants or withdraw funds through practically 45,000 ATMs with no fee. Opting-in for Brigit Plus furthermore unlocks the particular ‘Auto Advance’ feature. This Particular utilizes Brigit’s formula to forecast any time an individual might run reduced about cash in add-on to automatically includes you to be in a position to avoid an undesired overdraft.

Loan Sum

If an individual require typically the funds quicker compared to that, you may pay upwards to become in a position to $4.99 regarding a Lightning Rate down payment in order to your debit credit card. There’s furthermore a great optionally available EarnIn Australian visa debit card that permits regarding up to be in a position to $300 daily inside fee-free funds advances. Upon your own next payday, EarnIn will take away the particular advance quantity plus any type of suggestion or Super Rate payment from your linked looking at bank account. This Specific app allows users borrow funds immediately without having high costs, giving these people fast cash improvements whenever they require them most.

Exactly What If I Can’t Borrow Through Funds App?

Whenever obtaining a mortgage through Funds App Borrow, take note that will this specific function provides an individual together with a short-term loan. This cash could arrive via swiftly, nevertheless Cash Application fees a flat 5% payment regarding typically the loan that must be paid again more than 4 several weeks to end upward being able to stay away from a just one.25% financial charge. Plus regarding program, a few programs that will let a person borrow cash correct apart happily cost an individual a little fortune regarding the opportunity.

Effect Upon Credit Rating Score

Employ it regarding immediate cash in order to deal along with a great unpredicted one-time expense. If you’re usually behind, it’s period to be able to either earn additional money or tighten your belt a step or two. Any Time an individual receive your current income, all that comes away is the $100 you actually received — with out a good extra $15 or even more in curiosity. Typically The applications earn money inside various additional techniques, which includes tips in add-on to monthly costs. Referred To As Albert Quick, it’s free to use, nevertheless a person need to have a Guru subscription, which often has a month-to-month fee.

It likewise gives quick funds advancements of which may assist you remain afloat throughout difficult occasions. While numerous Albert characteristics are usually accessible for totally free, right today there is a payment associated with among $8 in add-on to $16 for accessibility to several associated with the particular app’s premium monetary assistance. Whilst Albert can’t handle all associated with your current funds regarding a person, typically the app does offer useful tools plus information regarding wiser money supervision.

Accessing an advance is usually uncomplicated within typically the app – simply touch the particular Time Clock symbol in typically the top still left nook, press “Funds Advance”, in inclusion to overview the particular terms just before signing upwards. Sadly, not necessarily all borrowers are usually entitled with regard to cash advancements. With Respect To illustration, if the software needs primary down payment regarding paychecks — plus an individual don’t have got it — an individual might want to discover a great application that will doesn’t demand direct deposit. Another chance is that will an individual don’t fulfill minimal bank balance requirements or activity, which a person could try out in order to job upon. Users may obtain cash advances upwards to $500 coming from typically the Vola software with zero credit verify, interest costs or direct deposit needed.

Finest For Multiple Economic Administration

If you want a great deal more money than most money advance programs offer, PockBox is a fantastic way in buy to observe how a lot a person can borrow without having downloading a fifty percent dozens of programs of which give you cash. Also far better, several of typically the borrowing programs upon the list usually are manufactured with regard to those together with bad credit rating – thus don’t stress if your current credit rating report is lower than you’d just like. A Person may meet the criteria along with no credit rating verify, and you’re not necessarily heading in purchase to obtain slammed together with those sky-high charges plus interest rates. Unlike other cash mortgage apps, Brigit reports your own obligations to end up being able to typically the credit score bureau to become in a position to help develop credit. Brigit has a free variation along with a pair functions, nevertheless in purchase to obtain the particular many out of the service, a person’ll want to pay $9.99 or $14.99 for each 30 days to become in a position to entry a great deal more functions.

- Cash advance applications are usually hassle-free and typically inexpensive nevertheless possess several disadvantages.

- A private mortgage from a bank, credit union, or on-line lender may end upward being a better alternative in case an individual require to end upward being in a position to borrow a large quantity in addition to distribute payments above a extended moment frame.

- FinanceBuzz reviews and prices items upon a range regarding quantitative plus qualitative conditions.

This Particular alternative offers instant comfort in add-on to helps stay away from costly payday financial loan programs. DailyPay in inclusion to Payactiv are part regarding the earned income accessibility industry, that means they function with your current company to be in a position to help to make part regarding your own salary available before payday. Funds advance applications just like the ones listed here don’t job with your current employer — they will essentially give a person cash by themselves just before an individual get compensated. Some Money App bank account holders could borrow money directly coming from Money App through typically the Money Application Borrow function.